Reserve accumulation has direct implications for the balance sheet of a central bank. A central bank may finance reserves build up either by increasing the high powered money i.e., monetary base known as reserve money or by wearing down its net domestic asset. The latter is intended to sterilise the impact on reserve money. Being mindful about the repercussions of reserve accumulation on monetary and economic indicators, a central bank conducts sterilisation operations. When a central bank is sceptical about the banking system's ability to intermediate and manage the extra liquidity resulting from reserve accumulation and/or is concerned about the potential for economic overheating stemming from extra liquidity, it opts for sterilisation to mop up the excess liquidity.

The central bank may neutralise the impact of reserve accumulation on reserve money in a number of ways that include selling domestic government bonds out of its portfolio or issuing debt securities against its name e.g, central bank bills. A central bank may use non-market instruments such as transferring the government's and other public financial institutions' deposits from commercial banks to the central bank, when the depth and breadth of the financial market is low. In some cases, the central bank raises reserve requirements for commercial banks so as to curb excess liquidity from the market as is the case of China. However, in practice the reserve requirement ratio is not frequently changed because of its widespread ramifications. Bangladesh Bank has historically been seen to utilise traditional sterilisation tools notably repo, reverse repo, BB bills, cash reserve requirement (CRR), treasury bond, Islamic bond etc.

Theoretically, there is no limit for the central bank to conduct sterilised reserve purchase because of its capability to let net domestic assets fall below zero by issuing new debt liabilities against its name. However, the sterilised reserve purchase entails some fiscal costs. The differential between the return paid on central bank liabilities issued in a bid to mop up excess liquidity and the return earned on foreign reserve assets adjusted for exchange rate risk may be termed as fiscal costs.

RESERVES AND MONETARY BASE: The reserve accumulation and reserve money (RM) are directly related in that the former leads to increase in the net foreign asset (NFA) of the central bank. And the reserve money comprises the net foreign asset and the net domestic asset. Thus, any increase or decrease in net domestic asset (NDA) essentially influences the RM. An increase of the NFA and a corresponding decrease in the NDA may imply the sterilisation of reserve accumulation by the central bank by running down the NDA. In this connection, in order to capture the historical trend with regard to sterilisation of reserve accumulation, one can assess the change (4-quarter) in NFA and NDA relative to the stock of RM lagged by 4 quarters. Figure-1 reveals the 4-quarter changes in NFA and NDA scaled by the stock of RM lagged by 4-quarter.

The positive values of NFA change and negative values of NDA change respectively corresponds to international reserve inflow and reduction in domestic assets held by the central bank. What is clear from Figure-1 is that during the initial period of exchange rate liberalisation, BB's extent of sterilisation was trivial. In fact, BB's acquisition of domestic assets during that period augmented the monetary consequence of reserves accumulation.

However, after the global financial crisis in 2008, BB's sterilisation policy reversed, from no sterilisation to sizable sterilisation until 2010Q2. Subsequently in the event of balance of payment pressure, reserve accumulation reversed its course and resulted in the decline in NFA. What stands out in Figure-1 is the persistent accumulation of reserves accompanied by greater extent of sterilisation during 2012Q3-2015Q3. During this period, surge in NFA was mainly sterilised via reverse repo operation, selling of BB bills and Islamic bond. In the last few weeks of the second half of FY14, the government temporarily suspended Treasury bill auctions, which led BB to raise the cash reserve requirement from 6 to 6.5 per cent in June 2014.

ESTIMATION OF THE DEGREE OF STERILISATION : Turning now to the quantitative estimation of the changes in degree of sterilisation, one can estimate a simple regression, where 4-quarter changes in the net domestic asset is regressed on the 4-quarter changes in the net foreign assets, both variables are scaled by the stock of reserve money of 4-quarter lag. The article uses the model specification as follows

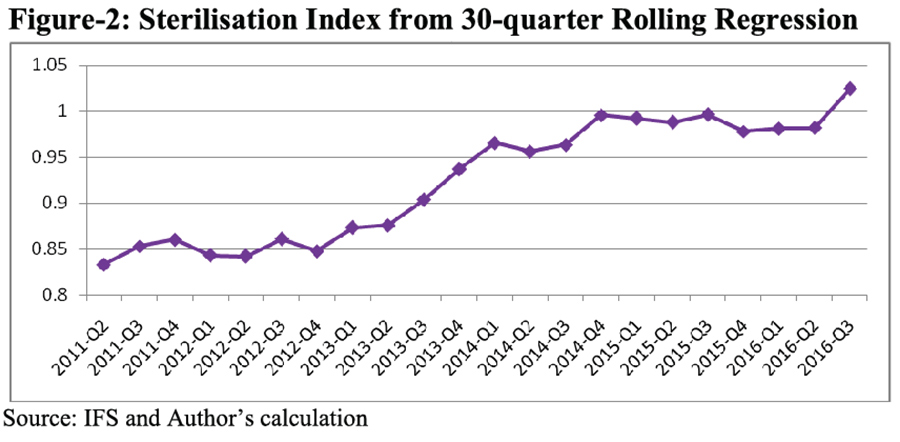

The estimated sterilisation index is plotted in figure-2 in which each point of time corresponds to the calendar date of the 30th quarter of relevant rolling sample. The graph shows that there has been a gradual increase in the degree of sterilisation going forward. The index reached close to 1 in 2014Q4 and remained around that level for four consecutive quarters. The overall trend appears to be consistent with findings in the previous sub-section.

Disclaimer: The views, thoughts and opinions presented here are based on the author's own analysis and do not necessarily reflect those of the author's employer (Bangladesh Bank), other organizations or any individual or group.

Saidul Islam is Deputy Director, Bangladesh Bank.

saidul914@gmail.com